MPPT Inverter Technology in Pakistan Explained

January 21, 2026

The “Home Gas Station”: Integrating Type-2 EV Chargers with Hybrid Solar Inverters

January 23, 2026Introduction: A New Bill Even with Zero Usage? 📉

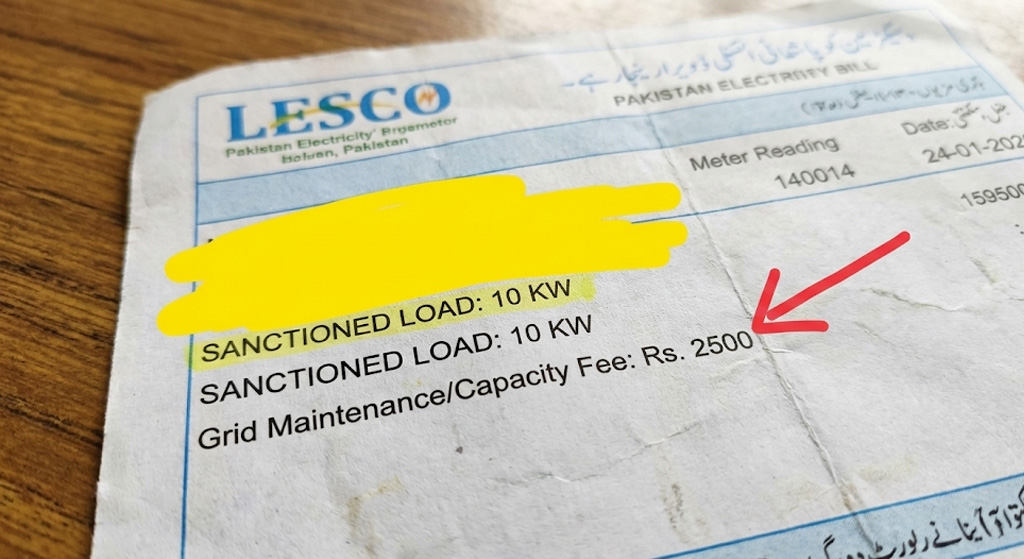

Imagine this: You have a 10 kW solar system. It is a sunny month, and you used zero units from the grid. Yet, WAPDA sends you a bill for thousands of rupees.

This is not a mistake. It is the “Capacity Charge.”

In 2026, the government and distribution companies (DISCOs) are moving toward a new tax strategy. They want to charge solar users a fixed fee based on their Sanctioned Load, regardless of how much electricity they actually pull from the wires.

What is a “Capacity Charge”?

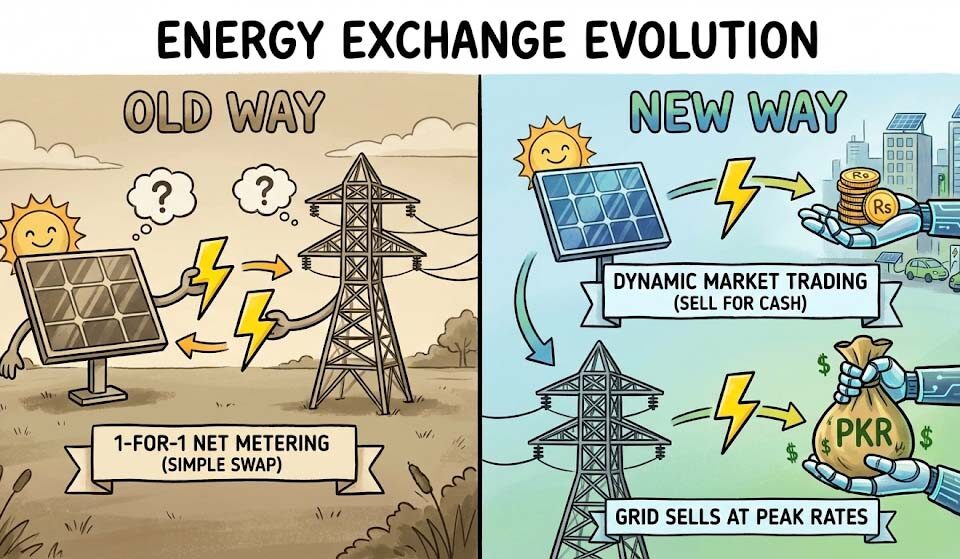

The national grid has to pay private power plants (IPPs) just to stay “available,” even if we don’t use their power. This cost is called a Capacity Charge.

Previously, solar users avoided these costs because they didn’t buy much from the grid. Now, DISCOs argue that solar users still use the grid as a “backup” or a “virtual battery.”1

The Proposal for 2026:

- A flat fee per kilowatt (kW) of your sanctioned load.

- For example, if the tax is Rs. 500 per kW, a home with a 10 kW load would pay Rs. 5,000 every month—even if they are 100% solar-powered during the day.

Why the Sanctioned Load Matters

Your “Sanctioned Load” is the maximum power your connection is allowed to draw (e.g., 5 kW, 10 kW, 15 kW).

Under the new 2026 rules:

- Fixed Cost: The grid tax is calculated on this number, not your consumption.

- Solar Limit: You can no longer install a solar system larger than your sanctioned load.

- The Shock: Many users with large 15 kW or 20 kW connections will face the highest taxes, even if their solar panels are doing all the work.

How to Protect Yourself from Fixed Taxes

The grid is becoming more expensive for solar users.2 To stay ahead of the “Capacity Charge” shock, you need a new strategy.

1. Optimize Your Sanctioned Load

Don’t keep a 20 kW load if your home only needs 10 kW. Work with Enon Traders to audit your energy needs and potentially reduce your sanctioned load to lower your fixed taxes.

2. Switch to Hybrid Systems

Since you are being charged for the grid anyway, use it as little as possible. By adding solar batteries, you can store energy and avoid the high “peak hour” rates that usually come on top of fixed charges.

3. Move Toward “Off-Grid” Thinking

The more independent you are, the less these taxes hurt. High-efficiency solar inverters allow you to prioritize your own battery and solar power over the grid at all times.

Why Enon Traders is Your Best Partner

Navigating government policy shifts is hard. Enon Traders provides the expertise to keep your ROI high.

- System Audits: We analyze your load and grid connection to minimize fixed tax exposure.

- Future-Proof Tech: We only install inverters that can handle both Net Metering and advanced battery storage.

- Expert Advocacy: Our team stays updated on NEPRA notifications so your system remains compliant and profitable.

Final Conclusion

The “Capacity Charge” is a major shift in how solar is taxed in Pakistan. While it makes the grid more expensive, solar remains the only way to escape the even higher per-unit prices of traditional electricity.

Don’t wait for the first “Shock” bill. Prepare your system today.

Lower Your Fixed Costs: Connect with Enon Traders Today!

Get a professional audit to see how the 2026 capacity charges will affect your bill.

| Connect With Us | Action Link |

| Chat Instantly on WhatsApp | Get a tax-saving solar audit: Click to Chat Now! |

| Visit Our Website | View our Hybrid Solar Packages: Official Website |

| Call Our Experts | Discuss your sanctioned load: Contact Page |